south dakota property tax laws

Unfortunately for businesses no two state sales tax nexus laws are alike. This is a matter of employer policy.

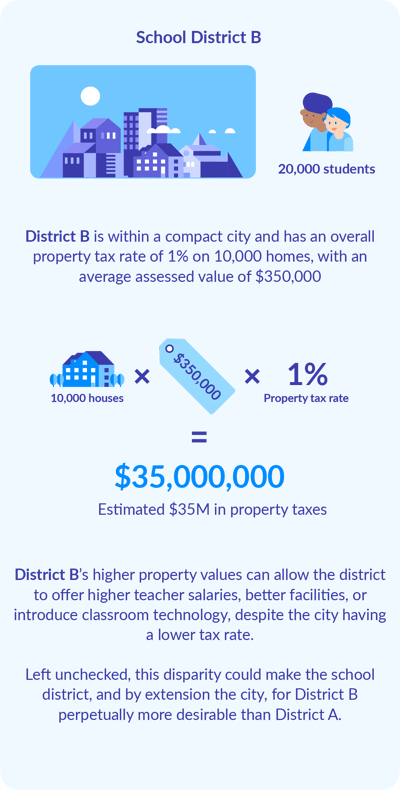

How State Local Dollars Fund Public Schools

Since Wayfair most but not all states have adopted new rules defining what establishes a sales and use tax obligation known as nexus.

. South Carolinas marital property laws are like the majority of states equitable distribution laws. The South Dakota Property Tax Portal is the one stop shop for property tax information resources and laws. In the state of South Dakota the laws regarding tax on shipping and handling costs are relatively simple.

And safe and sound business practices. 2018 Supreme Court Ruling Regarding Online Sales Taxes. Dakȟóta itókaga pronounced daˈkˣota iˈtokaga is a US.

Find contact information and major state agencies and offices for the government of South Dakota. Fair and equitable employment solutions. The Fair Labor Standards Act federal also does not require breaks.

Businesses who would like to apply for reinstatement with the Secretary of States office must first receive a tax clearance certificate from the Department of Revenue. Advance Child Tax Credit and Economic Impact Payments - Stimulus Checks. Find a variety of tools and services to help you file pay and navigate South Dakota tax laws and regulations.

Property Boundaries Lines and Neighbors FAQ. Results may include owner name tax valuations land characteristics and sales history. State Government State Agencies State Government Official.

Previous South Dakota Concealed Carry Weapon CCW. In South Carolina you can conceal carry with a resident issued CCW permit. Marital property is all the real and personal property acquired by the parties during the marriage and owned at the date of filing for divorce.

If you have concerns regarding fences trees or other property-related issues then you need to take prompt action. Proof of property with tax form if you are non-resident. On June 21 2018 South Dakota vWayfair Inc.

It is also part of the Great PlainsSouth Dakota is named after the Lakota and Dakota Sioux Native American tribes who comprise a large portion of the population with nine reservations currently in the state and have. Gross receipts tax is applied to sales of. States can now require ecommerce businesses to pay sales taxes where those businesses have an economic presence or nexus.

In the 2018 Supreme Court case South Dakota vs. Essentially if the item being shipped is taxable and if you charge for the shipping as part of the order then the shipping charge is considered to be taxable. North Dakota sales tax is comprised of 2 parts.

State in the North Central region of the United States. Some states include mapping applications whereby one may view online maps of the property and surrounding areas. Fencing Laws and Your Neighbors.

The mission of the South Dakota Department of Labor and Regulation is to promote economic opportunity and financial security for individuals and businesses through quality responsive and expert services. Federal Laws and Regulations. The sales tax is paid by the purchaser and collected by the seller.

South Carolina Gun Laws. Your firearm training certificate with an appended signature from you and the certified firearm instructor. South Dakota does not have a law that requires holiday pay.

Taxpayer Bill of Rights. Spouses in South Carolina have a right to all marital property. Tangible Media Property.

North Dakota imposes a sales tax on retail sales. South Carolina Property and Real Estate Laws. Wayfair Inc Et Al the court overturned a previous ruling that required a merchant to have physical nexus in order for a state to collect sales taxThis means that any state is now free to enforce collection of sales taxes on out-of-state online merchants.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. Many states offer online access to assessment records that may be searched by property address property id number and sometimes by owner name. South Dakota -d ə ˈ k oʊ t ə.

What is the state law on holiday pay. South Dakota does not have a law that requires an employer to provide rest breaks or meal periods. A South Carolina Attorney Can Help Resolve Your Property Dispute.

The decision overruled a longstanding physical presence rule allowing states to require remote sellers to collect and remit sales tax. Branches of the US. This again is employer policy.

The process of tracking individual state sales taxes that enforce economic nexus can be daunting time-consuming and expensive. Overturned a 1992 Supreme Court ruling. This system features the Property Tax Explainer Tool that provides a high level breakdown of some of the levies assessed within a specific jurisdiction numerous DOR property tax facts publications forms and multiple years of property.

New Municipal Tax Changes Effective January 1 2022 South Dakota Department Of Revenue

Property Tax Comparison By State For Cross State Businesses

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

Texas Taxable Services Security Services Company Medical Transcriptionist Internet Advertising

Property Tax Comparison By State For Cross State Businesses

Dakota County Mn Property Tax Calculator Smartasset

Property Tax Comparison By State For Cross State Businesses

How School Funding S Reliance On Property Taxes Fails Children Npr

South Dakota Estate Tax Everything You Need To Know Smartasset

Illinois Quit Claim Deed Form Quites Illinois The Deed

Wisconsin Quit Claim Deed Form 3 2003 Being A Landlord Wisconsin The Deed

South Dakota Department Of Revenue Facebook

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

Property Tax Comparison By State For Cross State Businesses

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes